Blog

Budget 2025

According to regulatory guidelines, a large-cap company is a listed company ranked from 1st to 100th on the Indian stock exchanges 1 terms of market…

An SWP is a feature offered by a mutual fund house, where an investor can withdraw a fixed amount of money at regular intervals, typically…

Amidst high valuation, wealth managers believe conservative investors moving from fixed deposits could consider an investment in equity saving funds that invest 15-25% of their…

Equity-debt asset allocation mandate Although both invest in equity and debt, balanced advantage funds (also known as dynamic asset allocation funds) are more flexible. They…

Overnight and liquid funds are a category of debt mutual funds. Overnight funds have a portfolio that invests in securities that mature in a single…

Gilt funds or government securities funds as they are called are a category of debt schemes. that invest only in bonds issued by the…

SWP is a feature offered by an open-end mutual fund scheme, where an investor can withdraw a fixed amount of money every month. Typically, on…

An arbitrage fund generates returns on the price differential in the cash and futures market. In such a scheme, the fund manager simultaneously buys…

We recommend following 60/20/20 as budget rule. Put 60% of income towards your needs 20% towards your wants and minimum 20% toward your savings.…

EPF TAXATION Tax Implications Unveiled The tax treatment of your EPF withdrawal depends on the duration of your contribution and your employment status. If…

STOCKS BOUGHT BY MUTUAL FUNDS IN SEP. 2023 Mutual funds were net buyers of 64 per cent of Nifty 50’s stocks in September. The highest…

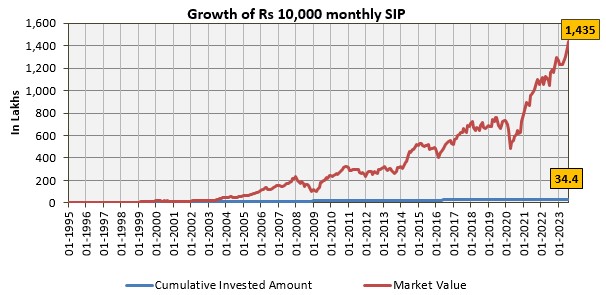

Wealth creator over nearly 3 decades HDFC Flexi cap Fund, erstwhile HDFC Equity Fund, has a wealth creation track record of over 28 years. The…

Why you should create an emergency fund? An emergency fund is created for unexpected events like losing active income and medical insurance. “An emergency fund…

RESIDENT SHAREHOLDERS Tax will be deducted at source under Section 194 of the IT Act at the rate of 10% on the amount of dividend…

PAN-Aadhaar linking deadline expired on 30 June 2023. For those who have still not linked their PAN with Aadhaar by now, it means that their…

WHAT IS THE MEANING OF ASSET ALLOCATION? Asset Allocation is the process by which investors decide what quantum of the portfolio should be allocated to…

Indian equity market is 3-4% of the global market capitalisation. Given this low share, there is a need to diversity equity portfolios geographically to manage…

Thematic funds are those that invest at least 80% of their total assets in stocks of a particular theme. For example, a PSU fund has…