Wealth creator over nearly 3 decades

HDFC Flexi cap Fund, erstwhile HDFC Equity Fund, has a wealth creation track record of over 28 years. The fund was launched in 1995 and is among the oldest diversified equity funds in India. Rs 10,000 invested in the fund at the time of its inception would have grown to more than Rs 13 lakhs as on 31st July 2023 (see the chart below). The CAGR returns since inception of the fund is 18.6%.

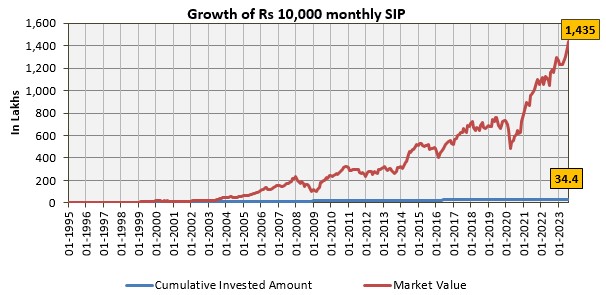

The Systematic Investment Plan (SIP) return of the fund is also a great wealth creation story. If you had invested Rs 10,000 per month (cumulative investment of Rs 34.4 lakhs) in the HDFC Flexi cap Fund through a hypothetical SIP you could have accumulated Rs 14.3 crores. The SIP XIRR since inception is around 21% (as 31st July 2023).

Outperformed the benchmark by big margin

The chart above shows the growth of Rs 10,000 investment in HDFC Flexi cap Fund versus the benchmark Nifty 500 TRI since till 1st January 1999. We are starting with 1st January 1999 since Nifty 500 TRI was launched in November 1998. You can see that the outperformance of HDFC Flexi cap Fund relative to the benchmark index is phenomenal. The fund was able to create nearly 3.5X (3.5 times) wealth compared to the benchmark index- Rs 14.1 lakhs versus Rs 4.0 lakhs. This visual of the chart may create an impression that Nifty 500 TRI did not perform well in this period. If you do the math, you will see that Nifty 500 TRI did extremely well, giving 16% CAGR returns; it is just that the CAGR return of HDFC Flexi cap was outstanding at 22%. You can see the power of compounding over long investment tenures in action here; a 6% difference in CAGR returns created nearly 3.5 times more wealth.

Disclaimer: – Mutual funds investments are subject to market risk. Please read the offer documents carefully before investing.